This acquisition was closed in early 2014. The property consists of 284 Class-A apartments units completed in 2013. The subject property is located in the suburbs of Birmingham, AL.

The Orchard Columbia

Columbia, SC

Investment Description

The Orchard Columbia is a student housing property consisting of 308 beds/84 units. The unit mix is comprised of three-bedroom units and four-bedroom units. The cottage-style product is extremely attractive to students and the property is typically 100% leased. The prime location is a major contributing factor to its success. Orchard is located 0.9 miles from the University of South Carolina and the next closest cottage style product is 2.5 miles away. In addition to the close proximity to campus, The Orchard Columbia offers its residents a pool, clubhouse, updated fitness center, individual security systems, and private parking. Unit interiors are outfitted with the latest upscale features such as stainless-steel appliances, granite countertops, 48″ screen TVs, and tile bathrooms. The Orchard Columbia is a property with significant operational upside.

View the WebsiteThe Square on Butler

Pittsburgh, PA

Investment Description

MultiVersity Housing Partners is pleased to present The Lawrenceville Assemblage, a conventional apartment investment opportunity located in the heart ofLawrenceville, City of Pittsburgh, PA. The subject property consists of three buildings that were constructed between 2014-2017 and contains 59 residential units and 7first-floor retail bays. Approximately 90% of the units are two-bedrooms with the remaining units being one-bedroom units.The amenities of the Subject Properties consist of a fitness center, covered parking,bike storage, dog wash, and superb location with a walkability score of 85. The unitinteriors have vinyl plank, some carpet flooring, granite countertops, and blackappliances. The current average rent per unit in comparable apartment properties is$2,500 for a two-bedroom unit and $1,800 for a one-bedroom unit.Presently, theSubject Apartment Properties are recording an average of $1,826 per two-bedroom unit and $1,407 per one-bedroom unit.Combined, the average rent delta across the three properties is $635.The Subject Properties are located on Butler Street, which is a prime corridor in the rapidly growing neighborhood of Lawrenceville. All seven street-level retail units are occupied and paying rent.The Subject Properties provide investors with the opportunity to purchase this well-occupied and Core located apartment assemblage, with tremendous operational upside, and reasonable capital expenditures for additional value-add return.

View the Website10 North

Bloomington, IN

Investment Description

This class A student housing property is located in downtown Bloomington and is just steps from IU Bloomington. The building was originally constructed in 2014 and contains 1-bedroom and 2-bedroom apartments as well as two retail tenants consisting of a bank and a bakery.

View the WebsiteThe Crest

Bloomington, IN

Investment Description

The Crest is a boutique off campus student housing community that is located in downtown Bloomington, and just steps from the IU Bloomington campus. The building was originally constructed in 2010 and consists of studios, 1-bedroom apartments and 2-bedroom apartments with granite countertops and LVT flooring.

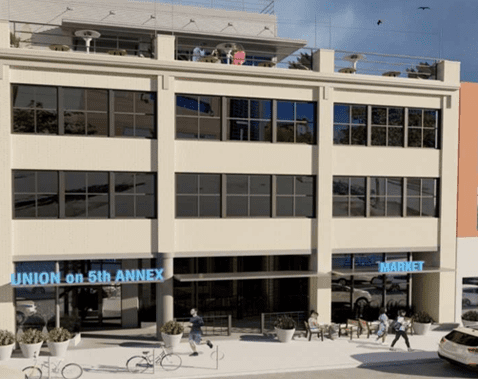

View the WebsiteUnion Annex

Pittsburgh, PA

Investment Description

Union Annex is a rare value-add opportunity located on prime Fifth Avenue. 1008-1114th Fifth Avenue is positioned across the street from PPG Arena and two blocks from Duquesne University. The surrounding entertainment options and close proximity to Duquesne University enable the property to be marketed as student-housing or as a conventional apartment building. The unit mix consists of residential units and 1 commercial unit. The first commercial unit encompasses the entire ground floor and the other commercial unit is a rooftop bar located on the fourth floor. The property is positioned in an Opportunity Zone across the street from PPG Arena in the Centre District which experiences high volumes of foot traffic and is within walking distance of retail shops and restaurants. Additionally, there is a significant amount of square footage on the fourth floor that is not being utilized. MVPM plans to execute renovations to add 4 new units to the fourth floor. Next, MVHP plans to modernize interiors and reconfigure the floor plans in existing units to add additional bedrooms.

The Revival on Carson

Pittsburgh, PA

Investment Description

The Revival on Carson is a two-building, 47-unit portfolio (known as Revival and Nakama) that is located in one of the city’s most highly demanded neighborhoods, Southside. The properties also consist of approximately 12,750 SF of first floor retail. These properties have corner frontage on Carson Street that are historically high foot traffic areas. This core location has attracted long-term retail tenants that have occupied the first floor retail space for several years.

Not only are the assets located in core locations, but The Revival has been renovated within the past year, and Nakama is nearing the completion of its renovations. These modern renovations have high-end finishes and enable the properties to achieve premium rental rates.

Revival – The Revival is a historic building in Pittsburgh notable for its intricate exterior appearance. Just as impressive, the recent interior unit modifications display stone countertops, stainless steel appliances, backsplash, and modern light fixtures. The total unit count at Revival totals 24 residential units with 2 commercial units occupying the ground floor. Revival has a fitness center located in the basement level of the property. Both properties can use this fitness center.

Nakama – This property is home to one of the most well-known Japanese restaurants in the City of Pittsburgh, known as Nakama. This commercial tenant has been occupying the ground floor for more than a decade and is a major staple in the Southside. Construction is currently taking place on the site to renovate the existing residential units. Additionally, the lot beside Nakama is being developed to add more residential units and a rooftop deck to the property. Once all renovations are complete, the unit count will total 23 residential units.

The Revival and Nakama are positioned across the street from each other which enables the tenants to share amenities. Between the two properties, tenants are offered a fitness center, rooftop deck, and shared parking lot. These amenities and new renovations give the properties a competitive edge against other apartment buildings in the market.

View the WebsiteThe Ridge Clemson

Clemson, SC

Investment Description

This luxury asset is a 184-unit/616-bed student housing investment opportunity completed in 2018, that serves the students of Clemson University. Built with the most comprehensive amenity package in the market, with common area of the property consisting of a resort-style pool, a lazy river, a 20-person hot tub, 20-foot outdoor Jumbotron TV, 24- hour study lounges, and large fitness club. The property is a mixture of 2Bd/2Ba and 4Bd/4Ba units, with the four-bedroom units designed into a townhome style and the two bedrooms in a multi-story building. The units consist of such high-end luxuries as stainless steel appliances, kitchen backsplash tile, granite countertops, vinyl wood plank flooring throughout the units, and unit garages with multiple storage areas.

View The WebsiteUnion On 5th

Pittsburgh, PA

Investment Description

This 94-bed/35-unit recently renovated student housing property is located in downtown Pittsburgh, PA, and is directly located adjacent to Duquesne University (9k students), and less than 2 miles from Point Park University (8k students) and University of Pittsburgh (40k students). The building was originally constructed in 1900 but was completely renovated at the end of 2016.

View The WebsiteRivers Edge at Carolina Stadium

Columbia, SC (Purchased while at CF)

Investment Description

Rivers Edge at Carolina Stadium is located less than 1 mile from the main campus of the University of South Carolina, which has an enrollment of 34,000 students. The property is also located directly across the street from the new USC Baseball Stadium (rated the best collegiate ballpark in the US). This student housing property was constructed in 1999 and consists of 240 units and 486 beds.

This value-add asset has already been significantly upgraded and is competitive with newer product, while still offering new ownership a tremendous upside opportunity. The property’s amenities include a resort-style pool, fitness center, business center, grilling areas, sand volleyball court, basketball court, disc golf, hammock garden, dog park, and a nearby walking trail along the Congaree River. A $2.5 million renovation was recently completed to include a complete renovation and expansion of the clubhouse, the addition of 95 premium units, additional furnished units, new signage, new exterior paint and more. The property is 94% leased and rents have increased 3% since YOY since owning the deal.

*MVHP still has an ownership interest, and was responsible for acquiring and redeveloping this deal, but MVHP does not manage the deal.

University Village at Slippery Rock

Slippery Rock, PA (Pittsburgh MSA)

Investment Description

University Village at Slippery Rock Student Apartments was acquired in August 2010. The property is located less than a I/4th of a mile from Slippery Rock University (a I0,000+/- Student PA State University) in Slippery Rock, PA. This 200-unit (632 bed) property, built in 2008, was acquired out of a 363-bankruptcy sale for a price significantly below replacement cost. The property has been consistently leased at 96% to 100% for the last 9 years. MVHP was responsible for overseeing and completing approximately $2.6 million in capital improvements and deferred maintenance on the subject property.

Current pre-leasing for the 2019-2020 lease term is 85% (as of 02/24/2019) with a rent increase to date equal to 3.5%.

Midtown 905

Denton, TX (Acquired while with CF)

Investment Description

Midtown Denton is in Denton, Texas less than one mile from the University of North Texas (UNT). Built in 2011, this purpose-built student property continues to have an excellent leasing history.

The University of North Texas has a 2016 enrollment of nearly 40,000 students and experienced over 11% enrollment growth over the past decade and has only 6,288 beds on-campus with only a freshman on campus living requirement. In addition, Texas Woman’s University (TWU) is located two miles from Midtown Denton. TWU has a current enrollment of over 15,500 students.

New ownership completed a value add program that has yielded a $65 per bed increase. Interior unit upgrades included: vinyl faux hardwood flooring, granite or acrylic countertops, lighting upgrades, cabinet hardware upgrades and furniture upgrades.

| Expected Deal ROE | 9% |

| Expected Deal IRR | 17% |

| Hold Period | 5-7 years |

The Ridge

Gainesville, FL

Investment Description

The Ridge at Gainesville is situated next to the University of Florida (enrollment of over 51,000 students) in Gainesville FL. The Ridge is surrounded with a wealth of infrastructure including major freeway access, dining and shopping centers, and is located on the UF shuttle route. This townhome and 4 story purpose built student community has a mix of 2b/2ba, 4bd/4.5ba and 5bd/5.5ba with garages. The common area amenities stand-alone against the competitors. Included is a large resort style pool, in ground spa, lazy river, 20 ft jumbo tron, fitness center, study lounge, gaming area and small convenience store.

| Expected Deal ROE | 9.6% |

| Expected Deal IRR | 16.6% |

| Hold Period | 5-7 years |

ULinQ North and South

Tampa, FL (Acquired while with CF)

Investment Description

ULinQ North and South is in Tampa, FL, less than 3/4 of 1 mile from the University of South Florida (USF). Built in 2004 (South) and 2005 (North), this purpose-built student property has an excellent leasing history that offers the ability to complete numerous value add opportunities and grow rental income during the hold period.

The University of South Florida had a 2017 enrollment of over 43,000 students and is expected to grow its enrollment by more than 1% each year over the next 5 years. USF only has 4,901 on-campus beds and only requires freshman to live on campus. In addition, off campus rents are projected to grow by 3.3% per year on average (or more) over the next 5 years.

| Expected Deal ROE | 11% |

| Expected Deal IRR | 20% |

| Hold Period | 5-7 years |

The Lex

Lexington, KY (Aquired while with CF)

Investment Description

The Lex is a 265-unit/645-bed investment opportunity boasting the premier location for student housing at the University of Kentucky. The property is within walking distance to all university classrooms and 172 restaurants, bars, and nightlife venues. Additionally, the irreplaceable location is home to 23,444 square feet of prime retail space, offering significant upside potential to a new investor.

There is also a recently completed traffic artery lending to increased accessibility, traffic, and visibility to major retail tenants. As the University of Kentucky continues to set new enrollment records, The Lex is primely situated as the mainstay, trophy asset of the Lexington market.

| Expected Deal ROE | 8% |

| Expected Deal IRR | 17% |

| Hold Period | 5-7 years |

University Orchard

Salisbury, MD (Purchased while at CF)

Investment Description

This Class-A, 2013 constructed student housing property consisting of 204 units/648 beds is located less than 1/2 mile from the main campus of Salisbury University. This is a Value-Add asset that was acquired at a price considerably below market. Furthermore, ownership spent $600k on amenities in the clubhouse and pool area. The Deal IRR returns are 21.17% and annual Yield/CoC average up to 11%. There was existing debt that had to be assumed with this acquisition.

The loan amount is $34 million, with an interest rate of 4.07%, and 1.5 Years of remaining IO (the loan had an total IO period of 3 year). Salisbury University is part of Maryland State University System. It has a total of 9,500+ students and growing on an annual basis. There is only capacity for 22% of the total student population to live on-campus.

| Expected Deal ROE | 11% |

| Expected Deal IRR | 21% |

| Hold Period | 5-7 years |

Alexan At Pier Park

Panama City, FL

Investment Description

Alexan Pier Park Apartments is a 360 unit market rate apartment property acquired by MVHP/CDP in partnership with a HNW investor and closed in early 2013. Ownership invested $300,000 in upgrading the property and units and implemented a mark-to-market rent increase strategy. Property was developed in 2008. This Class A asset was acquired for $91,000 per unit.

| Total Investment | $34,200,000 Total Capitalization |

| Required Equity | $9,450,000 |

| Senior Debt | $24,750,000 from an Agency Lender secured March 2013 |

| Deal ROE | 10.80% Avenge Annual ROE |

| Deal IRR | 19%+ IRR |

| Hold Period | Hold Period 2 Years |

Riverstone Apartments

Macon, GA

Investment Description

MVHP/CDP closined on the Riverstone Apartments, in late 2014. This 220 unit. Class-A multifamily apartment property located in Macon, GA.

| Total Investment | $22,975,000 Total Capitalization |

| Required Equity | $8,675,000 |

| Senior Debt | $14,300,000 provided from an agency lender |

| Deal ROE | 10% |

| Deal IRR | 20%+ |

Ashton Reserve

Charlotte, NC

Investment Description

The acquisition of Phases 1 of Ashton Receive in late 2013. Phase 1 consists of 322 Class-A+ apartments units.

The subject property is located in Charlotte, NC suburbs.

| Total Investment | $44,600,000 Total Capitalization |

| Required Equity | $12,700,000 |

| Senior Debt | $31,900,000 for Phase 1 provided by an insurance company lender. |

| Deal ROE | 9.2% |

| Deal IRR | 18.10% |

Uptown Village Townsend

Gainesville, FL

Investment Description

This property was acquired in mid-2014 and consists of 322 Class A units Iocated in Gainesville, FL. This property was constructed in 2012.

Ownership invested $500.000 in capital improvements.

| Total Investment | $36,800,000 Total Capitalization |

| Required Equity | $110,400,000 |

| Senior Debt | $26,400,000 provided by Freddie Mac |

| Deal ROE | 9% |

| Deal IRR | 17% |

Canopy Student Apartments

Gainesville, FL

Investment Description

Acquisition of a Class-A, 240-unit (770 bed) student housing property located 1 mile from the University of Florida. This property was constructed in 2007-08.

| Deal ROE | 9.6% to date |

| Deal IRR | 18.5%+/- Expected Deal IRR: 2.5x(+/-) multiple to GP Investors |

| Hold Period | 5 Years |

Carlton at Greenbrier

Chesapeake, VA

Investment Description

Carlton at Greenbrier is a 176 unit market rate apartment property acquired in partnership with a HNW investor and closed in late March 2013. Ownership invested $300.000 in upgrading the property and units and implemented a mark-to-market rent increase strategy. Property was developed in 2012.

| Total Investment | $29,050,000 |

| Required Equity | $7,936,000 |

| Deal ROE | 8.8% Annual ROE |

| Deal IRR | 17.1% IRR |

| Hold Period | 3 Years |

Lakeshore Crossing

Birmingham, AL

Investment Description

| Total Investment | $37,600,000 Total Capitalization |

| Required Equity | $9,900,000 |

| Senior Debt | $27,700,000 provided by Freddie Mac |

| Deal ROE | 9% |

| Deal IRR | I7%+ |

Soleil Apartments

Ponte Vedra Beach, FL

Investment Description

The Soleil Apartments were acquired by MVHP/CDP in venture with a HNW investor in August 2012. This Class A-, garden-style, market rate apartment property is located in the supply constrained and wealthy Ponte Vedra, FL market (a submarket of Jacksonville). This 240-unit property is located less than 1 mile from the Pante Vedra beaches. Renovations totaling $1.5 million were completed by mid-2013.

| Total Investment | $23,350,000 Total Capitalization |

| Required Equity | $7,100,000 |

| Senior Debt | $16,250,000 from an Agency Lender secured in June 2012 |

| Deal ROE | 9.1% ROE on average |

| Deal IRR | 20.4% Deal IRR; I.9x Multiple to LP; 3.0x Multiple to GP |

| Hold Period | 3 Years |

Enso

Atlanta, GA

Investment Description

The ENSO Apartments were acquired by MVHP/CDP in venture with a HNW investor in June 2012. This Class A+, mid-density, market rate apartment property with structured parking, is located in the mixed-use Glenwood Park PUD (located approximately 3 miles from Midtown Atlanta). This 325-unit property was completed in early 2012 and acquired from an institutional investor.

| Total Investment | $48,600,000 Total Capitalization |

| Required Equity | $12,100,000 |

| Senior Debt | $36,500,000 from an Agency Lender secured in June 2012 |

| Deal ROE | 10% ROE |

| Deal IRR | 25.1% IRR; 1.5x Multiple to LP; 2.5x Multiple to GP |

| Hold Period | 2 Years |

Lake at Windsor Parke Apartments

Southside - Jacksonville, FL

Investment Description

The Lake at Windsor Parke Apartments were acquired by MVHP/CDP in venture with a HNW investor in September 2012. This Class A-, 280-unit garden-style, market rate apartment property is located adjacent to the Windsor Parke Golf Club, a premier 18-hole Arthur Hills golf course. In addition, the property is less than 1 mile from the Mayo Clinic, and has quick access to the beach, Southside, and Jacksonville’s thriving downtown. Renovations totaling $1.5 million were completed in late 2013.

| Total Investment | $39,100,000 Total Capitalization |

| Required Equity | $9,100,000 |

| Senior Debt | $30,000,000 from an Agency Lender secured in September 2012 |

| Deal ROE | 9.5%+ ROE |

| Deal IRR | 16%+/- IRR |

| Hold Period | 3 Years |

Axis West Campus

West Campus, Austin, TX

Investment Description

The Axis West Student Apartments were acquired by MVHP in venture with a HNW investor in November 2012. This Class A+ mid-density, student property with structured parking, is located 3 blocks from the University Texas Austin. This 167-unit, 476 bed student property was completed in mid-2011 and acquired from a national developer. The subject provides a dynamic student lifestyle, with state of the art amenities and floor plans, including a beach entry pool, outdoor sound system, grilling areas, Café, Study lounge, and an outstanding fitness center. Unit features included 9′ ceilings, quartz counters, wood floors and stainless appliances.

| Deal ROE | 8.0% |

| Deal IRR | 10%+ IRR |

| Hold Period | 3 Years |

Dail College Inn

Raleigh, NC

Investment Description

Dail College Inn, a 121 unit (436 bed) student property acquired in partnership (as a Co-GP investor) with TPCO and an institutional investor in December 2011. Construction of this property was completed in 2005. This property was acquired off-market by the venture directly from the original developer.

Ownership completed a $1.2 million renovation including interior and exterior unit upgrades, addition of new amenities, and a complete renovation of clubhouse and leasing office.

| Deal ROE | 10.9% Average Annual ROE |

| Deal IRR | 20.1I% Deal IRR |

| Hold Period | 5 Years |

Domain at Towne Centre

Morgantown, WV

Investment Description

The Domain at Towne Centre was acquired off-market in late November 2012. This Class A+, garden-style, student property is located 1.5 miles from the University of West Virginia (34,000+ students) and is part of the 1.5 million SF Towne Centre retail development. This 336-unit, 912 bed student property was completed in mid-2011 and acquired from a national developer/owner.

The subject provides a dynamic student lifestyle unmatched by any other asset in the market, with state of the art amenities and floor plans, zero entry pool, outdoor sound system, grilling areas, Cafe, Study lounge, and state of the art fitness center. Unit features include 9′ ceilings, granite counters, wood floors and stainless appliances.

| Expected Deal ROE | 11.1% ROE To Date; 11.95% ROE average expected over the Hold Period. |

| Expected Deal IRR | Expected Deal IRR of 25%+ |

| Hold Period | 7 Years |

Six Forks Station

North Raleigh, NC

Investment Description

Six Forks Station Apartments were acquired by MVHP/CDP in venture with a HNW investor in early 2012. This Class B+, market rate, garden apartment property is located in the high income North Raleigh submarket. This 321-unit property was completed in three phases from 1995 through 2009. Renovations totaling $2.5 million were completed by Mid-2013. The property is desirably located, with direct access to two major highways (1-540 and 1-440), Six Forks Station provides great proximity to restaurants, shopping. movies, nightlife, and prime businesses. Amenities include 2 pools, a 24-hour fitness center, two tennis courts, basketball court/all sports court, and two playgrounds.

| Total Investment | $32,300,000 Total Capitalization |

| Required Equity | $7,100,000 |

| Senior Debt | $24,500,000 from an Agency Lender secured in March 2012 |

| Deal ROE | 7.5% ROE on average |

| Deal IRR | I 2% |

| Hold Period | 3 Years |

University Suites

Raleigh, NC

Investment Description

University Suites, a 136 unit (518 bed) student property, was acquired in August 2011. The property was completed in phases from 2001 to 2004. This property was acquired off-market by MVHP directly from the original developer. The property maintained occupancy levels of 97% to 100% every year since acquisition in 2011. MVHP was solely responsible for completing a $2.2 million renovation, including interior and exterior unit upgrades, the addition of new amenities, a complete renovation of the clubhouse, and a new pool.

| Total Investment | $21,870,000 Total Capitalization |

| Required Equity | $5,896,000 |

| Senior Debt | $14,000,000 from an Agency Lender secured August 2011 |

| Deal ROE | 10.5% |

| Deal IRR | 22.10% Deal IRR; 2.1x multiple to the LP investor; 40% IRR and 3.7x Multiple to GP Investors |

| Hold Period | Sold After 4 Year Hold |